GLOBAL

INDUSTRIE

News

Share on

Challenges and prospects for the French electronics manufacturing sector

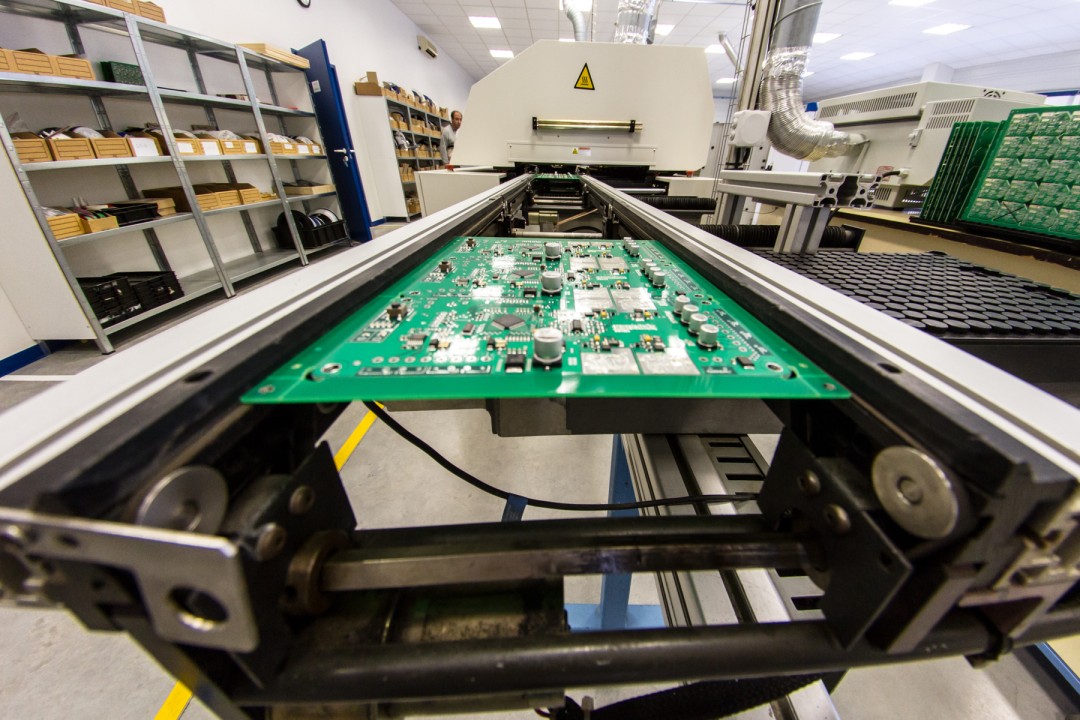

The need for a strong electronics sector at the heart of the industry of the future

In an unprecedented context of technological acceleration, particularly via the Internet of Things, and the explosion of digital technology, the aim of this study is to imagine the future of French electronics manufacturing between 2020 and 2025. The team in charge of the project thus successively draws up an inventory of the sector and an analysis of the demand of the main markets and the French ecosystem in terms of employment, training, regulations and capacity for innovation, before making a comparison with the offer from abroad.

This work, carried out via 65 interviews conducted with the main players in the sector in France and abroad, two workshops involving more than ten participants, and the examination of four textbook cases, made it possible to establish forecasts for the short and medium-term development of electronics manufacturing and draw up recommendations for manufacturers and public authorities. With a vital objective, since the aim is nothing less than to guarantee the competitiveness of a sector whose products are at the heart of the digital transformation of companies.

Electronics is indeed present in all industrial sectors. It lies at the heart of the digital transformation of companies and therefore of their transition to the industry of the future, providing them with intelligence, autonomy, connectivity and performance thanks to the diversity of its players. It encompasses manufacturers of components, testing and measuring equipment and products as well as subcontractors, design offices, distributors or companies developing embedded systems and software.

A mixed position in the world

Driven historically, before the 2000s, by the demand of the telecommunications market and large-scale production, the French electronics industry subsequently suffered from the generalisation of the concept of factory-free or “fabless” companies advocated in particular by big manufacturers such as Alcatel, HP and IBM. This strategy has been deadly for the sector in France because it has led to the relocation of numerous production units outside the country and the emergence of powerful and integrated electronic ecosystems in Asia. It has also caused difficulties in access to components, a significant reduction in productive investments, the closing of numerous training courses and partial disinterest from public decision-makers.

It would be wrong, however, to paint too black a picture of the situation. Our country has indeed succeeded in remaining competitive in the professional electronics field thanks to a complete value chain which occupies first place in Europe both in terms of subcontracting with high added value and in the electronic components field, on a par with Germany.

In the final analysis, although boasting four EMS (Electronics Manufacturing Services) companies in the world top 50, France’s power in the electronics field nevertheless still lags behind that of its rivals in Asia and North America.

The electronics sector in France in 2019

Opportunities to be seized

Although high-volume markets such as consumer electronic products, computer equipment and telecommunications will remain mainly dominated by Asia over the next few years, France has a real card to play in professional electronics, both in the historic segments of the car industry and aerospace and in emerging sectors such as smart devices.

It is no secret for anyone that the automotive industry is current undergoing major upheavals: engine size reduction, electrification, regulations on emissions, increasing connectivity and sophistication of equipment, etc. Consequently, whereas electronics represented 22% of the production cost of a vehicle in 2014, this percentage had risen to 40% less than two years later. It has become strategic: the world market for automotive electronics, which was 600 billion dollars in 2015, should reach 1,250 billion in 2020 with an average growth rate of 14.4 % per year.

To a lesser extent, the aerospace sector also offers numerous opportunities for French electronics manufacturers due to the visibility of its order books and its production volumes. While the total value of electronic assembly was 1.4 billion dollars in 2016, it should thus reach 1.7 billion in 2021.

Lastly, smart devices, particularly for industrial applications, B2B health care or smart cities, may represent a tremendous opportunity for the sector: low volumes, high variability, short times-to-market, major customisation needs, etc. The connected objects market presents very high growth with an average annual rate of 20 to 40% over the next 5 years. The growth is such that this market could represent 1,400 billion dollars worldwide in 2021.

Weaknesses to be addressed

French electronics suffers however from three major weaknesses. The first of these is the average age of its production machinery, estimated at 7 or 8 years old, which it is having difficulty in replacing, a major factor holding back its competitiveness. The second obstacle is the rigidity and relative disorganisation of its supply chain, with its down times and idle inventory, which prevents it from offering its new customers sufficient agility. Lastly, its industrial fabric is made up of small structures which are admittedly ideal to meet the needs of local customers but insufficient beyond that level: only around twenty have a critical mass capable of providing a greater volume of production and thus operating at national and international level.

These specifically French weaknesses are compounded by international competition. This manifests itself through the arrival of foreign competitors in the country, where they had previously been relatively absent. This leads to a necessary rise in expertise and increasingly extensive automation of machinery to resist these competitors, and is coupled with a trend towards widening of the positioning of EMS companies and semi-conductor manufacturers on the value chain of the electronics sector.

On the basis of this analysis of its strengths and weaknesses, the study presents three possible scenarios for the development of French electronics between now and 2025.

The status quo, a first scenario for the future which is… doomed to fail

In this scenario, the sector would allow itself to be carried by the current momentum of demand, taking limited risks. It would therefore content itself with upgrading its industrial equipment and standardising its products upstream. Its relations with its customers would continue to follow a conventional pattern with areas for development mainly concerning increased traceability and data sharing.

Although this would admittedly allow greater volumes to be supplied to its historic markets, such as the car industry and aerospace, and a relative improvement in collaboration between the subcontractor and the end customer, such minimum action would lead to little organisational transformation. This scenario also comes up against four major handicaps: an excessive accumulated shortfall in investment, continuing limited ability to attract talent, a critical production mass incapable of meeting large volumes, and the emergence of new foreign players on French soil.

The verdict of the study is very clear: if this scenario were applied, it would simply be fatal to the sector in a context of slowing of world economic growth and global commercial tensions.

Agility and technological excellence, a second scenario which is … essential!

This scenario is that of a proactive sector, which invests and acts without necessarily having identified a short-term demand, but which seeks to dominate new B2B application markets through its technological excellence.

It is based on a level of investment enabling positioning on new markets, on the development of areas of excellence in electronics manufacturing and on a strategy of partnerships with technology suppliers and disruptive practices.

This strategy should enable the French electronics sector to have genuine international influence combined with relocation of production, together with stronger automation and technological integration which would enable relations between players to be interconnected and facilitated. Other major benefits would be the setting up of a horizontal and agile organisation, and a genuine improvement in professional expertise which would turn electronics engineers into partners and fully-fledged proactive players.

This strategy is nevertheless not without risks. Such a fundamental transformation takes a long time to set up. Too great a specialisation of the markets or the technologies might also not guarantee a sufficient production volume over time and would leave out B2C IoT players and start-up customers in favour of the B2B IoT. It is nevertheless this solution which the study considers it essential to set up if we are to avoid a loss of national sovereignty on key technological building blocks and a weakening of numerous other industrial sectors through a domino effect, electronics being omnipresent.

A paradigm shift, a third scenario which is… desirable

This would be characterised by a major change in professions within the value chain. This implies simultaneously rethinking the positioning, the service offer and economic models. In concrete terms, the sector would rely on a better articulation of skills and collaboration in terms of linking between hardware and software and would implement territorial Open Knowledge strategies. It would encourage co-design and co-contracting with the sector’s customers, thereby creating players of significant size and proven financial strength. The development, industrialisation and manufacturing of electronics would be in line with a policy based on ODMs (Original Design Manufacturers, i.e. companies which manufacture a product which will be sold under another brand name).

This strategy would allow a nationwide capital and industrial restructuring of the sector and a radical transition of the supply chain to a 4.0 co-contracting model of worldwide excellence. It would also lead to a relocation of production in France in line with the principle of open, agile and cooperating ecosystems and would encourage a model of local subcontracting with high added value.

It is not however free of risks, foremost among which are the possibility of this model simply being rejected by professionals, insufficient levels of investment expenditure and a loss of confidence on the part of historic customers who would favour foreign subcontracting or internationalise expertise in electronics.

Despite this, the study sees this scenario as being desirable for the development of the sector. It even considers that the change must take place in the short term, within the next two years at most, and be based primarily on a shift in the relationships between the players concerned towards greater cooperation and increased mobilisation of all existing financing systems. If competition were to become tougher and if technologies of a key nature in the short term for national sovereignty were to be weakened, it even recommends additional financial aid from the State in the form of an investment fund backed if necessary by an endowment fund financed by customers.

Initiatives underway… or about to be underway!

The electronics sector therefore needs to react collectively, and this crucial effort has already been initiated by the “Electronics Industry” Strategic Sector Committee (CSF). The work of this Committee concerns both the adaptation of skills and jobs to the needs of the sector and the acceleration of its transition to industry 4.0, particularly via increased cooperation between all its players. Its action aims to establish an international strategy tending towards European leadership and to provide electronics engineers with genuine mastery of the key technologies for future markets. These include Artificial Intelligence, particularly via the provision of the hardware/software support necessary for its development.

While these recommendations for change and the actions already undertaken by players in the sector within the framework of the CSF are necessary and appropriate, they must nevertheless imperatively be complemented by other actions highlighted by the study based around three main themes.

The first theme concerns the promotion of the sector. The study thus recommends the creation of a brand name, such as “Electronics France” for example, which would enable communication to be simplified and accelerated. It also calls for the development of a French event of international scope, like GLOBAL INDUSTRIE, in which electronics would have high visibility, and, more generally, the strengthening of the position of French manufacturers in the sector in trade fairs in France and abroad.

The second theme emphasises the concept of collaboration. This involves closer ties between EMS companies and other sectors, such as plastics processing or mechatronics, to offer a complete solution to downstream customers. There is also a need, on the part of customers, for closer collaboration with EMS companies ahead of projects, and with component manufacturers, particularly in the case of printed circuits and passive components. The study emphasises the crucial nature of the relationship both with traditional customer sectors, such as the automotive industry, aerospace, defence and the medical sector, and with new sectors such as the IoT. The French electronics industry must quickly (re)gain their confidence, by proving to them that it is possible to find excellent partners within this industry in France, and that it is engaged in a historic effort to transform itself to increase its competitiveness. It must convince them that this process of transformation serves not only electronics manufacturing but also all the players concerned by its pivotal role in the industry of the future. The electronics sector being structurally global, France’s industrial strategy must focus realistically and selectively on the emergence of excellent national players within a policy of European cooperation.

Lastly, the third theme concerns financing. The study highlights the fact that the financial situation of the players concerned does not allow them to make on their own the investments needed to meet the challenges presented. As the necessary transformation of the sector cannot be carried out solely by the manufacturers in this sector, it must be supported by a range of ambitious actions involving both public and private funding. It is therefore necessary to establish better directing of existing aid to electronics manufacturing players and encourage better use of the existing systems by these players. There is also a need to mobilise more European funds through concerted action with other countries and to reactivate the special depreciation system, which has proven itself in the past, to encourage the investment which is necessary for companies’ development.

The whole of the study is available on request at info@snese.com

2019.11.20